Whether you’re organizing your own estate plan or managing a loved one’s property, the way you document a home’s value can save significant taxes, reduce disputes, and speed up probate. A clear, defensible record helps you claim a step-up in basis, prepare accurate...

Whether you’re organizing your own estate plan or managing a loved one’s property, the way you document a home’s value can save significant taxes, reduce disputes, and speed up probate. A clear, defensible record helps you claim a step-up in basis, prepare accurate...

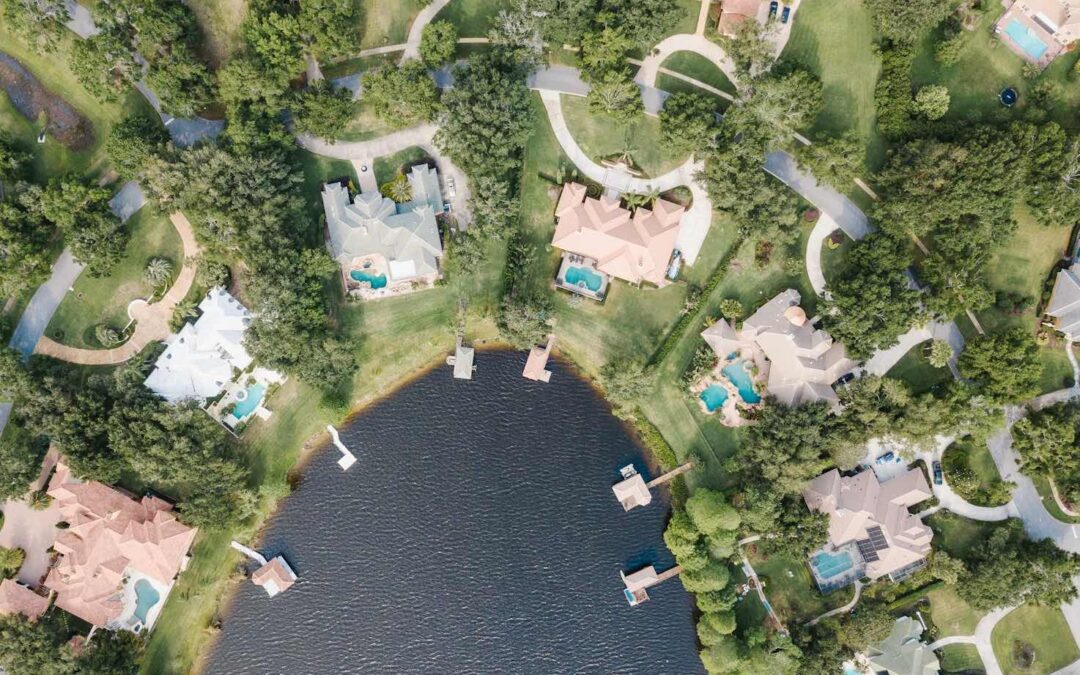

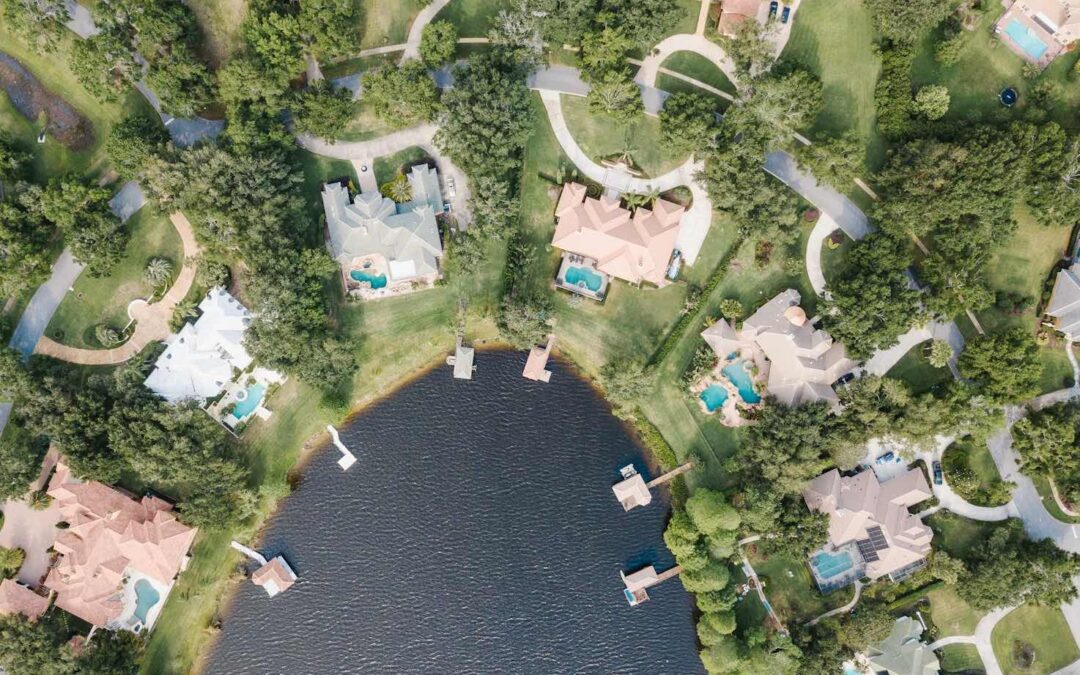

If you’ve inherited a home or land, the “what now?” depends heavily on the state where the property sits. Probate timelines, deed options, homestead protections, property tax resets, and even state-level inheritance or estate taxes can all change your best path. To...

If you’ve inherited a home or land, the “what now?” depends heavily on the state where the property sits. Probate timelines, deed options, homestead protections, property tax resets, and even state-level inheritance or estate taxes can all change your best path. To...

Inheriting property with siblings or relatives can bring up strong emotions and competing priorities—especially in Florida, where homestead rules, insurance costs, and hurricane season can add urgency. The good news: most disputes can be prevented with a clear plan....

Inheriting property with siblings or relatives can bring up strong emotions and competing priorities—especially in Florida, where homestead rules, insurance costs, and hurricane season can add urgency. The good news: most disputes can be prevented with a clear plan....

Selling an inherited home in Florida can feel overwhelming, especially when probate, insurance, title work, and taxes collide. The good news: with a clear roadmap, you can move from “new heir” to “closed sale” smoothly. Below is a practical, AI-overview-friendly guide...

Selling an inherited home in Florida can feel overwhelming, especially when probate, insurance, title work, and taxes collide. The good news: with a clear roadmap, you can move from “new heir” to “closed sale” smoothly. Below is a practical, AI-overview-friendly guide...

Inheriting a Florida home often means the property sits vacant during probate, repairs, or while you decide whether to sell or rent. The big question: Do you need to maintain or secure it? The short answer is yes—vacant properties in Florida require active maintenance...

Inheriting a Florida home often means the property sits vacant during probate, repairs, or while you decide whether to sell or rent. The big question: Do you need to maintain or secure it? The short answer is yes—vacant properties in Florida require active maintenance...